Ayaw pagpamuhunan gawas kung andam ka nga mawala ang tanan nga salapi nga imong gipuhunan. Kini usa ka taas nga peligro nga pagpamuhunan ug dili ka mapanalipdan kung adunay sayup. Paggahin ug 2 ka minuto aron makat-on pa

Serbisyo para sa copy trading. Ang among Algo awtomatik nga nagbukas ug nagsira sa mga patigayon.

Ang L2T Algo naghatag ug labing mapuslanon nga mga signal nga adunay gamay nga peligro.

24/7 nga trading sa cryptocurrency. Samtang natulog ka, nagbaligya kami.

10 minuto nga pag-setup nga adunay daghang mga bentaha. Ang manwal gihatag uban sa pagpalit.

79% Rate sa kalampusan. Ang among mga resulta makapahinam kanimo.

Hangtod sa 70 nga mga patigayon matag bulan. Adunay labaw pa sa 5 nga mga pares nga magamit.

Ang binulan nga mga suskrisyon magsugod sa £58.

Litecoin is an established cryptocurrency that was first launched in 2011. If you’re wondering unsaon pagpalit sa Litecoin in a simple and safe way – this guide is for you.

Here, we walk you through the process with a regulated brokerage site that charges 0% commission. We also explore the risks and potential rewards of adding Litecoin to your investment portfolio.

8cap - Pagpalit ug Pagpuhunan sa mga Asset

- Minimum nga deposito nga 250 USD lang para makakuha ug tibuok kinabuhi nga access sa tanang VIP channels

- Pagpalit labaw sa 2,400 nga stock sa 0% nga komisyon

- Pagbaligya ang liboan nga mga CFD

- Ang mga pondo sa pagdeposito gamit ang debit / credit card, Paypal, o transfer sa bangko

- Hingpit alang sa mga negosyante sa newbie ug daghang gikontrol

Kaundan

How to Buy Litecoin in 10 Minutes or Less – Fast Track Guide

If you’re looking for a fast-track walkthrough of how to buy Litecoin in under 10 minutes – simply follow the 4-step guide outlined below!

- Lakang 1: Paghimo usa ka account nga adunay kasaligan broker nga cryptocurrency - You will first need to open an account with a regulated broker that lists Litecoin. Be sure to check out the broker’s fee structure and supported payment methods.

- Lakang 2: Kompletoha ang Proseso sa KYC - You will need to upload a copy of your government-issued ID – should you wish to buy Litecoin with fiat money.

- Lakang 3: Paghimo usa ka Deposit - Deposit some funds into your newly created brokerage account – ensuring you meet the minimum requirement as stipulated by the platform.

- Step 4: Buy Litecoin – With a funded brokerage account, you can now proceed to buy Litecoin. You can do this by searching for Litecoin, entering your stake, and confirming the order.

The above step-by-step walkthrough shows you how easy it is to buy Litecoin when using a regulated broker. You will, however, need to choose a suitable platform – which we cover in the next section.

Ang 78.77% sa mga account sa namaligya nga mamuhunan nawala ang salapi sa pagnegosyo sa mga CFD sa kini nga tagahatag

Best Broker to Buy Litecoin

Adunay daghan mga broker sa cryptocurrency that allow you to buy Litecoin. When choosing the right platform for you, make sure you explore metrics surrounding fees, commissions, regulation, payment types, and minimum investment amounts.

To help you choose a suitable broker, below we review the best platforms to buy Litecoin in a safe and low-cost manner.

1. AvaTrade – Overall Best Broker to Buy Litecoin

We found that AvaTrade is the overall best place to buy Litecoin. This online broker specializes in CFD instruments - meaning that you can speculate on the future price of Litecoin without needing to own the underlying tokens. In turn, this removes the need to worry about storage and wallet options.

When you buy Litecoin CFDs at AvaTrade, you will not be charged any trading commissions. You will also have the option of applying leverage to your Litecoin position - which allows you to trade with more capital than you have in your AvaTrade account. Limits will depend on your country of residence.

In addition to Litecoin, AvaTrade offers plenty of other digital token markets - all of which support long and short positions. You can also trade stocks, indices, forex, commodities, and more. Getting started at AvaTrade takes minutes and the minimum deposit amount is just $100. You can do this with a debit/credit card or bank wire.

When it comes to safety, you can buy Litecoin CFDs at AvaTrade in a secure manner. This is because the brokerage site is regulated by seven reputable financial bodies. AvaTrade also offers a convenient way to access the crypto markets, as you can complete your trading orders online or via the mobile app.

- 0% commissions and tight spreads

- Licensed and regulated by ASIC, FSCA,and the FSA

- Thousands of trading markets

- Admin ug inactivity fee human sa usa ka tuig nga walay trading

2. EightCap - Pagbaligya Labaw sa 500+ Wala’y bayad sa Komisyon sa Mga Asset

Ang Eightcap usa ka sikat nga MT4 ug MT5 broker nga gitugutan ug gi-regulate sa ASIC ug sa SCB. Makit-an nimo ang kapin sa 500+ nga labi ka likido nga merkado sa kini nga plataporma - ang tanan gitanyag pinaagi sa mga CFD. Kini nagpasabut nga ikaw adunay access sa leverage kauban ang mga kapabilidad sa mubu nga pagbaligya.

Ang gisuportahan nga mga merkado naglakip sa forex, mga palaliton, mga indeks, bahin, ug mga cryptocurrencies. Dili lamang ang Eightcap nagtanyag og mubu nga mga spreads, apan 0% nga mga komisyon sa standard nga mga account. Kung magbukas ka usa ka hilaw nga account, mahimo nimong ibaligya gikan sa 0.0 pips. Ang minimum nga deposito dinhi kay $100 lang ug mahimo nimong pilion nga pondohan ang imong account gamit ang debit o credit card, e-wallet, o bank wire.

- Usa ka regulated broker sa ASIC

- Pagbaligya labaw sa 500+ nga wala’y bayad sa komisyon

- Kusog kaayo ang pagkaylap

- Ang mga limitasyon sa leverage nagdepende sa imong lokasyon

3. VantageFX – Ultra-Ubos nga Spreads

Ang VantageFX VFSC ubos sa Seksyon 4 sa Financial Dealers Licensing Act nga nagtanyag og daghang instrumento sa panalapi. Tanan sa porma sa mga CFD - kini naglangkob sa mga bahin, indeks, ug mga palaliton.

Pag-abli ug pagnegosyo sa usa ka Vantage RAW ECN nga account aron makuha ang pipila sa labing ubos nga spreads sa negosyo. Trade sa institutional-grade liquidity nga nakuha direkta gikan sa pipila sa mga nag-unang institusyon sa kalibutan nga walay bisan unsa nga markup nga idugang sa atong katapusan. Dili na ang eksklusibong probinsya sa hedge funds, ang tanan aduna nay access niini nga liquidity ug hugot nga spreads sa $0.

Ang pipila sa mga pinakaubos nga spreads sa merkado mahimong makit-an kung magdesisyon ka nga magbukas ug magbaligya sa usa ka Vantage RAW ECN account. Pagnegosyo gamit ang institutional-grade liquidity nga direktang gikuha gikan sa pipila sa mga nag-unang institusyon sa kalibutan nga adunay zero markup nga gidugang. Kini nga lebel sa pagkatubig ug pagkaanaa sa mga manipis nga pagkaylap hangtod sa zero dili na eksklusibo nga katuyoan sa mga pondo sa hedge.

- Ang Labing ubus nga Mga gasto sa Pagbaligya

- Minimum nga deposito nga $ 50

- Leverage sa 500: 1

4. LonghornFX – Trade Litecoin With High Leverage

LonghornFX is an online trading platform that specializes in low fees and high leverage limits. Regarding the latter, this top-rated platform allows you to trade Litecoin at a leverage of up to 1:200. Put simply, this means that you can multiply your stake by a factor of 200x. As such, a $100 stake would allow you to open a position worth $20,000.

In terms of supported pairs, LonghornFX allows you to trade Litecoin against the US dollar (LTC/USD) and Bitcoin (LTC/BTC). Other supported cryptocurrencies include the likes of Ethereum, Dogecoin, Ripple, and EOS. You can also trade other financial instruments - such as forex, commodities, and stocks.

When it comes to fees, LonghornFX charges a super-low commission rate of just $6 for every 1 BTC traded. You can choose from a long or short position on each supported market - meaning that you can attempt to profit from both rising and falling prices. Getting started at LonghornFX takes minutes and you can deposit funds with a debit/credit card or Bitcoin.

- CFD investment app para sa mga nagsugod nga adunay hugot nga spreads

- Ubos nga komisyon ug taas nga leverage hangtod sa1: 500

- Parehas nga mga pag-atras sa adlaw ug daghang mga kabtangan sa CFD

- Gipalabi sa platform ang mga deposito sa Bitcoin

5. Currency.com – Best Litecoin Platform for Mobile Trading

Currency.com is an online trading platform that offers a huge number of markets and financial products. This top-rated provider is likely to be of interest if you wish to trade Litecoin on your mobile phone. This is because Currency.com offers a popular app that is very easy on the eye and thus - is ideal for beginners.

You can use your debit/credit card to deposit funds in a safe and secure environment, not least because Currency.com is regulated and fully compliant with KYC rules. Once you have funded your account, you can then buy and sell Litecoin at low fees and tight spreads.

Much like the other platforms that we have discussed today, Currency.com also allows you to trade Litecoin with leverage. The platform offers a maximum limit of 1:500 on major forex pairs and less on crypto assets like Litecoin. Other supported markets on this platform include tokenized shares, bonds, commodities, and indices.

- Trading platform with tight spreads

- Competitive nga komisyon ug taas nga leverage hangtod sa 1:500

- Ang parehas nga adlaw nga pag-atras ug daghang lainlaing mga merkado nga gi-token

- Ang mga deposito sa Bitcoin gipalabi niini nga app

How to Buy Litecoin – Step-by-Step Walkthrough

So now that we have discussed the best brokers to buy Litecoin, we can now walk you through the step-by-step process of completing your purchase.

Lakang 1: Pag-abli sa usa ka Crypto Broker Account

Your first step will be to open an account with a top-rated brokerage site. It goes without saying that the crypto broker must give you access to Litecoin. However, you also need to look at other key metrics – such as what fees the broker charges, whether you will have access to leverage, and what payment methods are supported.

Ang 78.77% sa mga account sa namaligya nga mamuhunan nawala ang salapi sa pagnegosyo sa mga CFD sa kini nga tagahatag

Lakang 2: Kompleto ang KYC

If you’re looking at how to buy Litecoin with fiat money, then you will first need to go through a KYC process. This means that your chosen broker will need to verify your identity.

In most cases, this process can now be completed in less than two minutes. All you need to do is upload a copy of your government-issued ID – such as a passport or driver’s license.

Lakang 3: Mga pundo sa Deposit

Once you have completed the KYC process at your chosen brokerage site, you can then make a deposit. The likes of VantageFX and AvaTrade support a wide range of payment methods – covering debit/credit cards, e-wallets, and bank transfers.

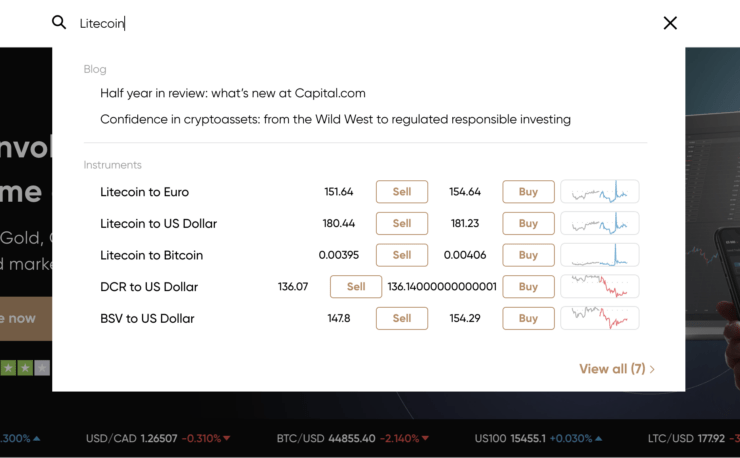

Step 4: Search for Litecoin

Now that you have some money in our crypto broker account, you can proceed to search for Litecoin.

Make sure that you select the right pair, as many brokers in this space offer several Litecoin markets.

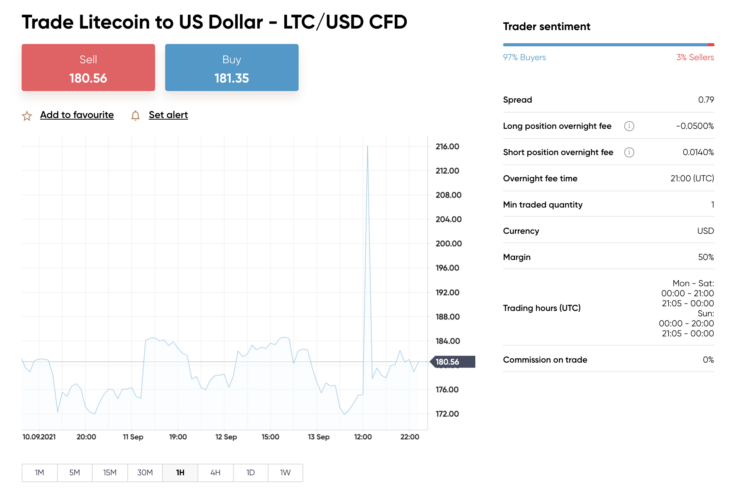

Lakang 5: Ibutang ang Buy Order

The final step is to place a buy order. This tells your chosen broker that you think Litecoin will increase in value. You will also need to enter your stake – which is the amount of money that you will be risking on your Litecoin investment.

Step 6: How to Sell Litecoin

Once your Litecoin buy order is placed, you will then need to keep an eye on the markets. After all, at some point, you will likely want to sell your Litecoin position back to cash so that you can realize your profits.

To do this, you can head back to the brokerage site that you used to place your buy order. After logging in and heading over to your portfolio, look out for the ‘Sell’ button. Once you place a sell order on your Litecoin position, this will close the trade and the proceeds will be added to your brokerage account balance.

Labing maayo nga Litecoin Wallets

Like all digital currencies, Litecoin needs to be stored in a wallet. The only exception to this rule is if you elect to buy Litecoin via a Pagpamaligya sa CFD platform. The reason for this is that the CFD instrument tracks the value of Litecoin in real-time, meaning that the underlying asset does not exist.

Not only are Litecoin CFDs better in terms of security, safety, and convenience – but they are also cheaper to trade. Nevertheless, if you are looking for the best Litecoin wallets in the market right now – consider the following options.

Trust Wallet – Overall Best Litecoin Wallet

Trust Wallet – which was created by Binance, comes in the form of a mobile app that can be downloaded on iOS and Android devices. This wallet not only stores Litecoin, but thousands of other digital currencies.

This is because Trust Wallet supports multiple blockchain networks. It also gives you access to decentralized exchanges – such as Pancakeswap and Uniswap.

Ledger Nano – Best Litecoin Wallet for Security

If you are looking to buy a large quantity of Litecoin tokens and plan to hold for a number of months or years, you might want to consider a hardware wallet. The best option in this respect is the Ledger Nano – which offers water-tight security features.

The wallet remains offline at all times and your private key is stored within the hardware device itself. Expect to pay in the region of $100 for the Ledger Nano – and only purchase it directly from the manufacturer’s website.

Unsa ang Litecoin?

Litecoin is a cryptocurrency that launched in 2011. This makes it one of the longest-standing digital tokens in the market. Litecoin was forked from the Bitcoin network and subsequently upgraded for faster, cheaper, and more scalable transactions.

For example, Litecoin transactions take 2.5 minutes to process while Bitcoin requires a full 10 minutes. With this in mind, the main use-case for Litecoin is that it is potentially suitable as a global payments system.

Litecoin Mining

Litecoin can be mined by purchasing specialized hardware and plugging it into a live server. Back in the early days of Litecoin, anyone with an internet connection had the potential to mine Litecoin.

However, and much like its Bitcoin counterpart, competition in this space is fierce. This means that unless you have a significant amount of capital to invest in advanced hardware, you will find it very difficult to mine Litecoin in a profitable manner.

Litecoin Investment Risk

There are, of course, investment risks to consider when you buy Litecoin. This is no different from any other crypto asset. The price of Litecoin can be very volatile, so you might find that the value of your investment rises and falls at a much faster rate than say – stocks or ETFs.

You also have to remember that Litecoin isn’t the only blockchain project that aims to become a global payments network. In fact, there are heaps of alternative blockchain projects that can facilitate much faster and cheaper transactions than Litecoin – so this in itself is a major risk to consider.

You also need to consider the risks involved in storing your Litecoin tokens in a private wallet. After all, if you misplace your private keys or your wallet is hacked remotely – it’s unlikely that you will be able to recover your Litecoin tokens.

How to Buy Litecoin – Conclusion

This guide has explained everything there is to know when learning how to buy Litecoin for the first time. Not only have we discussed the best Litecoin brokers for the job, but the specific steps involved when completing your purchase.

If you are ready to buy Litecoin right now – you can do so in less than five minutes with all of the pre-vetted platforms that we have reviewed on this page. Just remember to consider the investment risks involved when buying a volatile digital currency like Litecoin – as you could lose some or even all of your capital.

8cap - Pagpalit ug Pagpuhunan sa mga Asset

- Minimum nga deposito nga 250 USD lang para makakuha ug tibuok kinabuhi nga access sa tanang VIP channels

- Pagpalit labaw sa 2,400 nga stock sa 0% nga komisyon

- Pagbaligya ang liboan nga mga CFD

- Ang mga pondo sa pagdeposito gamit ang debit / credit card, Paypal, o transfer sa bangko

- Hingpit alang sa mga negosyante sa newbie ug daghang gikontrol

FAQs

How do you buy Litecoin with Paypal?

The best way to buy Litecoin with Paypal is with a regulated broker that supports e-wallets. This is possible with a number of CFD trading platforms - such as AvaTrade.

How do you buy Litecoin with a credit card?

All of the Litecoin trading platforms discussed today allow you to deposit funds with a debit or credit card. When using AvaTrade for this purpose - you won't be charged any deposit fees.

Can you buy Litecoin on Coinbase?

Yes, you can buy Litecoin on Coinbase. However, Coinbase is very costly when it comes to investment fees. For example, if you elect to buy Litecoin with a debit or credit card at Coinbase, you will be charged 3.99%.

How do you buy Litecoin with a bank transfer?

You can deposit funds via bank transfer at many Litecoin brokers. However, do note that bank transfers can take a few working days before the funds arrive. As such, debit/credit cards and e-wallets like Paypal are the better options.

How do you sell Litecoin?

You can sell Litecoin back to the same broker that you used to make the purchase. In fact, when using any of the brokers that we reviewed on this page, there is no requirement to withdraw your tokens. This means that you can cash out your Litecoin investment by simply logging into your brokerage account and placing a sell order.