Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

The general assertion that Bitcoin and Gold are correlating pair cannot be disputed. Over time, these instruments have proven their true trends to be synonymous. In late October, Bitcoin and Gold broke out of their mid-term descending channel with a massive surge of about +50% after Xi Ping, the Chinese President release on Blockchain and Cryptocurrencies. Since then, both Bitcoin (marked $1400) and Gold (touched $1516.0) have been making a corrective pullback.

Apart from that, most Chinese cryptocurrencies such as NEO (NEO), Ontology (ONT) Tron (TRX), EOS amongst others follow the suit with an insane price gain within the shortest period. Today, Bitcoin and Gold have been falling and it appeared they have found a low over the last hour.

Is there any correlation Between Bitcoin and Gold?

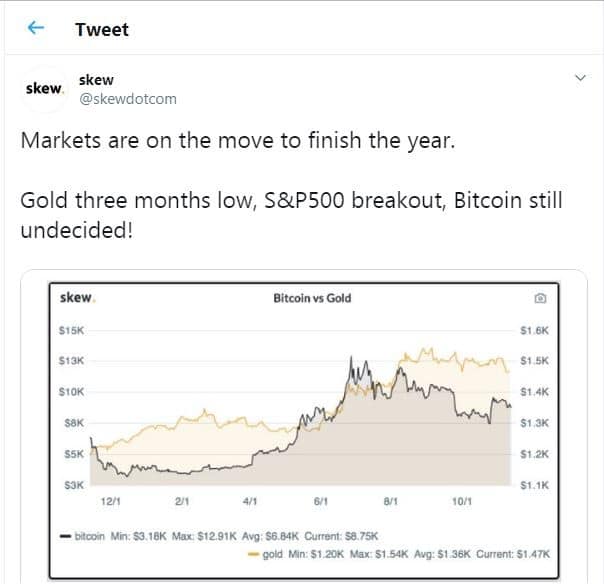

Just a few hours ago, a twitter analyst, SKEW @skewdotcom twitted that Gold has been on a three month’s low, followed by S&P 500 – which broke higher in November, although the equity indices have been on the rise since the beginning of the year. However, the analyst opined that Bitcoin is undecided at the moment. According to the presented statistical graph, Bitcoin is currently trading at $8750 with a year-to-date (YTD) minimum trading of $3180, a maximum of $12910 and an average of $6840.

The derivative chart further revealed Gold’s price at $1470 with minimum trading of $1200, followed by a maximum of $1540 and an average of $1360. While mentioning the S&P 500 to be on a breakout, the analysis was strictly based on both Bitcoin and Gold to show a similar movement in price actions. And most especially, revealing the current conditions and trends of these trading pairs.

From a technical standpoint, Bitcoin and Gold have been quite similar in terms of trends and pattern and most times follow the same market sentiment, although their fundamentals may not be the same depending on the angle of the news surrounding them. Nevertheless, these instruments have demonstrated a significant movement to be considered a true correlation over a long time. This assertion may be untrue in the future but the past and present moves have justified the instruments to be twins in the trading world.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus