Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

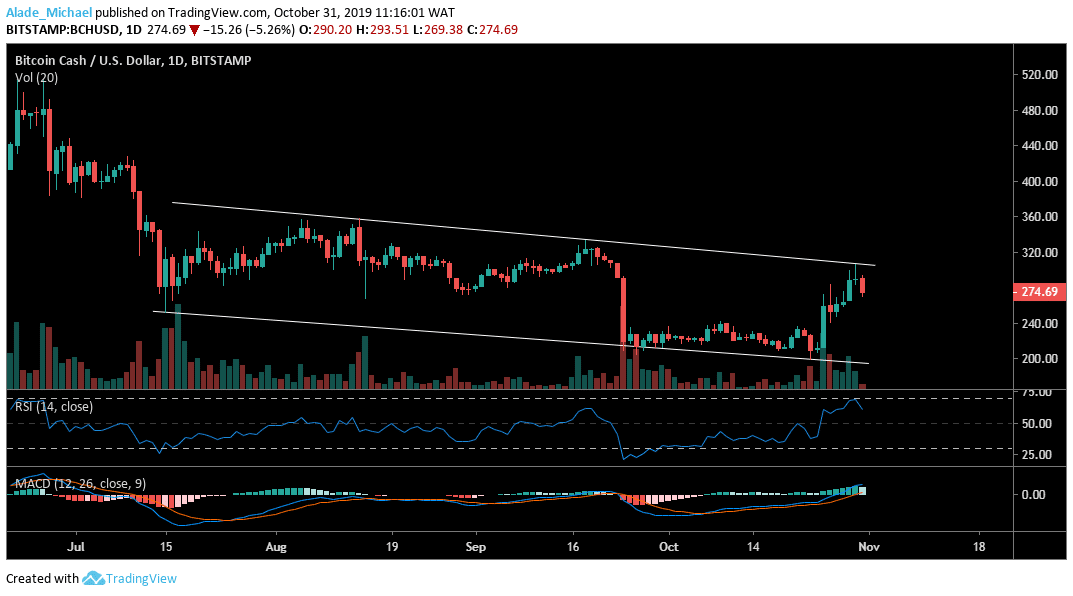

Bitcoin Cash (BCH) Price Analysis: Daily Chart – Bullish

Key resistance levels: $306, $335, $358, $370

Key support levels: $270, $250, $242, $206

Last week, we mentioned the triangle breakout but now Bitcoin Cash is shaping inside a descending channel pattern since mid-July. The October 25 rebound at $206 has made BCH record a weekly high of $306 while trading in a channel boundary. Yesterday, the price was rejected at $306 and now looking for support at $270 which was recently rejected.

A daily close below the $270 would bring us to $250, $242 and 206 support in a couple of days. Today, the RSI 70 was rejected to signal a potential reversal, although the MACD has seen a bullish climb which shows that the buyers lurk around the corner. If $270 area can act as support, we may see a bullish continuation to $335, $358 and $370. However, we need to clear the $306 resistance before considering a further rise.

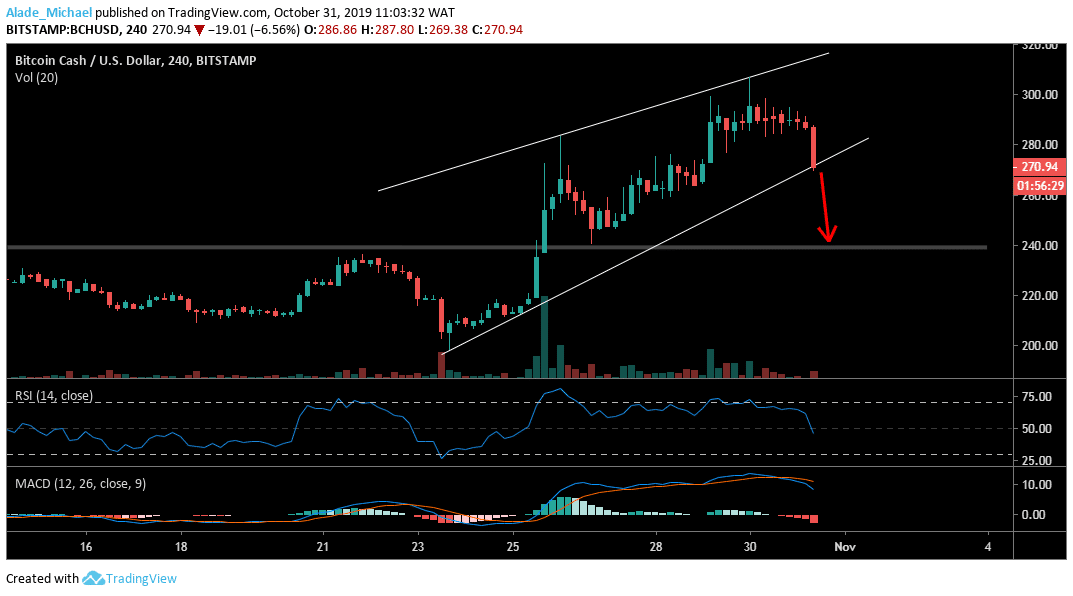

Bitcoin Cash (BCH) Price Analysis: 4H Chart – Bullish

The 4-hour chart is looking bullish but underway for a bearish move. At the time of writing, Bitcoin Cash is testing the ascending wedge’s support at $270.94 following the last 24-hours low volatility which was characterized by doji candles. Meanwhile, the current bearish candle formation has just signalled a bearish footing. Support is likely at $250-$240 areas once we have a clean wedge break-down.

Surging below grey horizontal support might further turn BCH weak at $220 and $210. While the RSI crosses down the mid-band, the MACD is positive but now oscillating towards the zero levels. Alternatively, we can expect a bounce if the wedge’s lower boundary can support the market. The resistance to watch out for is $290-$306 zones, although further buying target lies at $320. For now, Bitcoin Cash remains bullish but a breakout is imminent!

BCH SELL SIGNAL

Sell Entry: $269

TP: $243 / $212

SL: $310

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus