Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

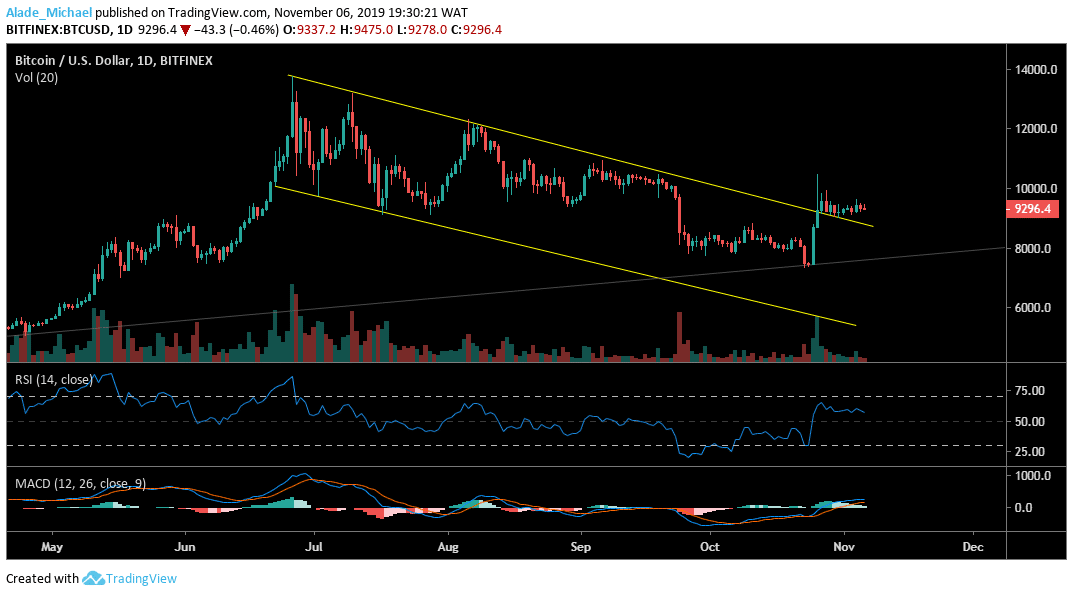

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

Key resistance levels: $9600, $9800, $10000

Key support levels: $9200, $9000, $8820

Above the $9000, Bitcoin is still looking bullish on the daily chart but last 10 days indecisiveness has suspended the bullish actions. For the past 24-hours, BTC has been finding it difficult to continue the late October surge which has stuck price actions at an average of $9200. Bitcoin’s breakout still remains at $9500, followed by $9800 and $10000 resistance.

In the opposite direction, Bitcoin currently held support at $9000 and $8800 but the $9200 support remains solid. The technical indicators have seen a little drop due to the ongoing bearishness in the market. We can expect a rebound if the $9000 support can hold.

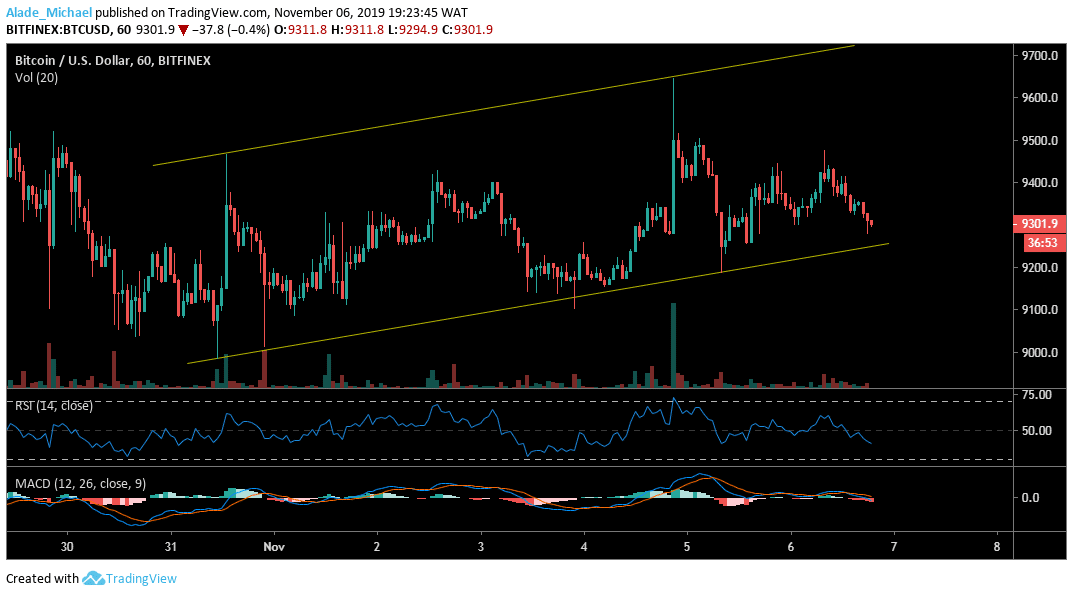

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

Bitcoin’s price has remained intact in the rising channel for the past week now. But now, the market has been trading sideways around the channel’s lower boundary since yesterday due to capitulation. Following the pattern formation, Bitcoin is expected to climb towards the upper boundary but volatility is contracting for a while now.

If volatility expansion occurs, on the upside, BTC may spike to $9400, $9500, $9600 and $9700. On the downside, the $9100, $9000, $8900 and $8800 support may hold further selling pressure. As shown on the RSI, Bitcoin is currently looking bearish as the MACD shows that the bears are in play but the market is still in a bullish zone

BITCOIN BUY SIGNAL

Buy Entry: $9279

TP: $9551 / $9400

SL: $9200

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus