Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

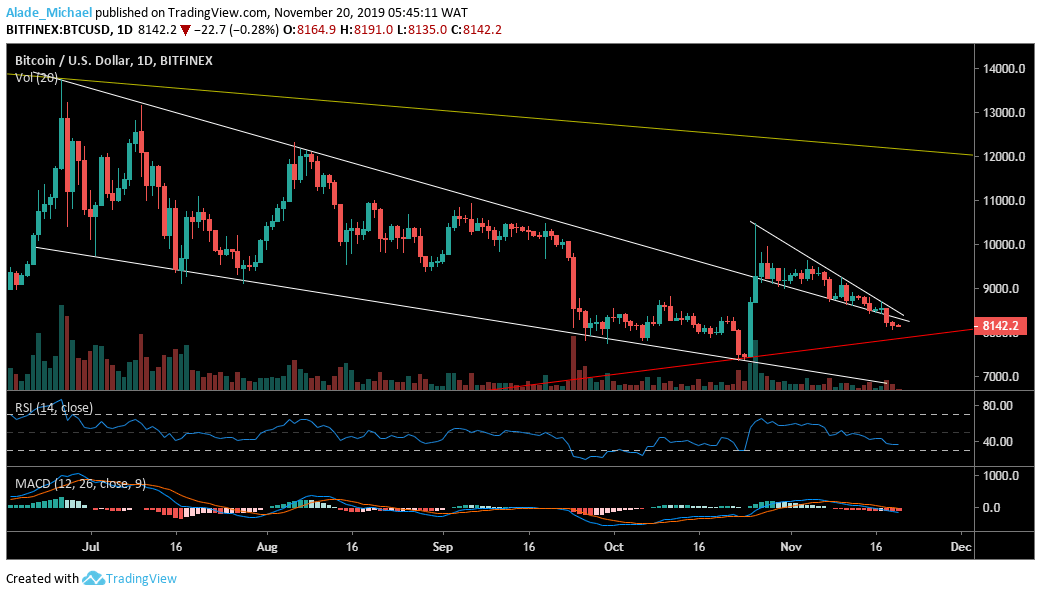

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

Key resistance levels: $8300, $8500

Key support levels: $8000, $7800

Bitcoin’s trading is back in the descending channel as a result of the past few days of decline, making the market to now sit on $8000 support, near the red ascending trend line. Bouncing off the $8000 support might allow Bitcoin to rise back to near resistance at $8300 and $8500 on the upside.

But considering the latest bearish reactions, Bitcoin may break-down $8000 to meet October low, although the September low ($7800) may hold BTC for a while. However, the RSI has dropped back near the 30 levels to show a sign of weakness in the market. The MACD has confirmed a bearish takeover as more declines can be expected.

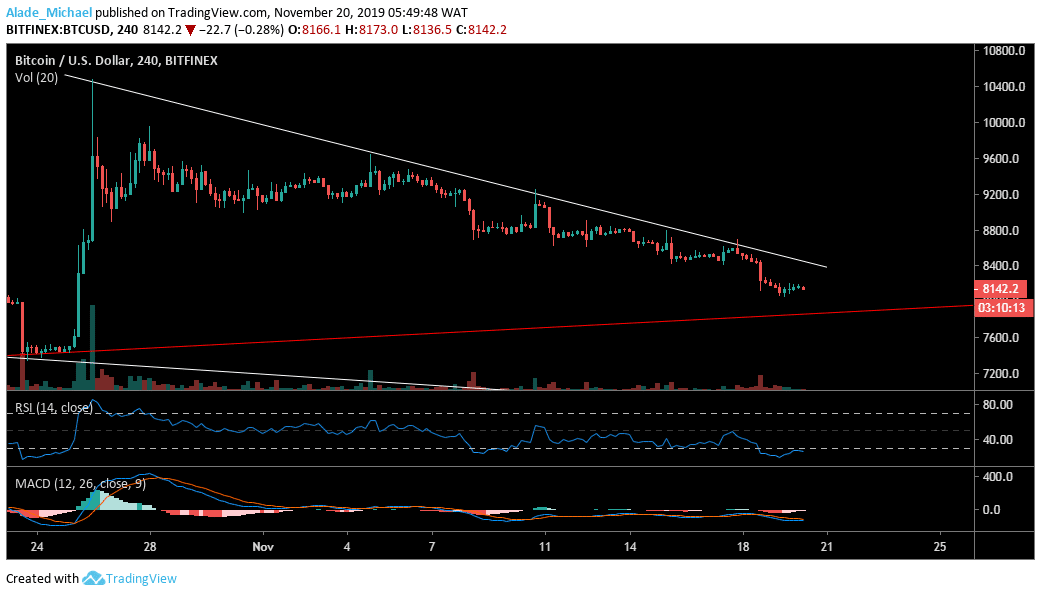

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Having broken supports, Bitcoin is now leaning on $8000 support which has been through bear target $9000 support breaks. The $7350 support might be on sight if Bitcoin further slips beneath the red diagonal support. However, the $7900 – $7800 support zones may further suppress selling pressure.

Meanwhile, the technical indicators are in the bearish territories which suggest that Bitcoin is under a lot of pressure. If the market can rely on the red diagonal support, we can expect BTC witness a strong bullish surge to $10400. But for now, near support lies at $8300, followed by $8400 which remains a breakout level for Bitcoin.

BITCOIN SELL SIGNAL

Sell Entry: $8051

TP: $7878

SL: 8213

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus